Wallets and private keys

Wallets are programs that manage your private keys which are used to acces your cryptocurrency. Most of the time such a private key is represented to the user as a "seed phrase" of 12 or 24 words. These words in that specific order give you acces to your coins which means you can acces the same wallet balance from multiple devices by importing that seedphrase. It's called a "private key" because you should never share it with anyone else! It's crucial to make a backup of your wallet when using any significant amounts, because otherwise you might lose acces to your cryptocurrency in the event of a lost phone or a crashed hard drive. Naomi Brockwell gives a great introduction to wallets in the video below:

Cryptocurrencies stand out because they give the user full control over their own money so they are self sovereign. Of course it is still possible to delegate custody to someone else, this is more akin to a crypto bank where a trusted third party manages your money. Confusingly they are sometimes called "custodial wallets" and in contrast to "non-custodial" or "self-custodial" wallets discussed before where the user is self sovereign. Many coins have been lost because of they were left on an untrustworthy exchange hence the saying not your keys not your coins. This website will only discuss noncustodial wallets.

Types of wallets

‘Hot wallet’ means the device is connected to the internet, this includes mobile, desktop, web wallets etc. Hot wallets are convenient for day to day use in contrast to cold storage which is more security focused. Many cryptocurrency users make use of both!

'Cold wallet’ means a wallet for long term offline storage, also called ‘cold storage’. This category includes paper wallets and hardware wallets. Offline storage is considered more secure because it's not susceptible to malware like keyloggers, screen captures, etc.

Things to look out for

Featured wallets

More information on the two BCH wallets featured in Naomi's video can be found below as a quick

alternative to comparing many options.

For a list of Bitcoin Cash wallets see the overview page

where wallets are listed by category (mobile, desktop, hardware & web) and with filters for specific

features!

The Bitcoin.com wallet is probably the most used Bitcoin Cash mobile wallet with over 50 million

wallets created.

The wallet has been very popular in the BCH community because of its laserfocus on ease of use.

The user interface is very polished and the app is fast & responsive which make it

very convenient for day to day useage.

The focus on usage is clear from the shop section which features popular businesses where you

can use BCH as well as a map where you can find merchants in your local area who accept Bitcoin

Cash.

The wallet is also popular because of its features: it supports sending BCH through

shareable links, sweeping paper wallets, multisig, buying and selling BCH,

requesting a specific amounts and scanning (BIP70 type) payment requests from merchants.

Besides BCH the Bitcoin.com wallet also supports BTC and ETH.

There main disadvantages are that the wallet is not open source, that it promotes the bitcoin.com

VERSE token with ads and that it uses a special derivation path (m/44'/0'/0') which is not standard

for BCH and hence cannot be imported by some other wallets.

Cashonize is a relatively new Bitcoin Cash Wallet focused on BCH DeFi-usecases!

The Cashonize Wallet was created as a way for users to be able to send and receive CashTokens, both fungible tokens & NFTs.

Cashonize has since added BCH WalletConnect and CashConnect, making it the ideal wallet to explorer the different BCH Dapps.

Cashonize was originally only a webwallet, but now it is also available as a desktop and mobile application!

A drawback of Cashonize is that it's a single-address wallet so it sacrifices on user-privacy.

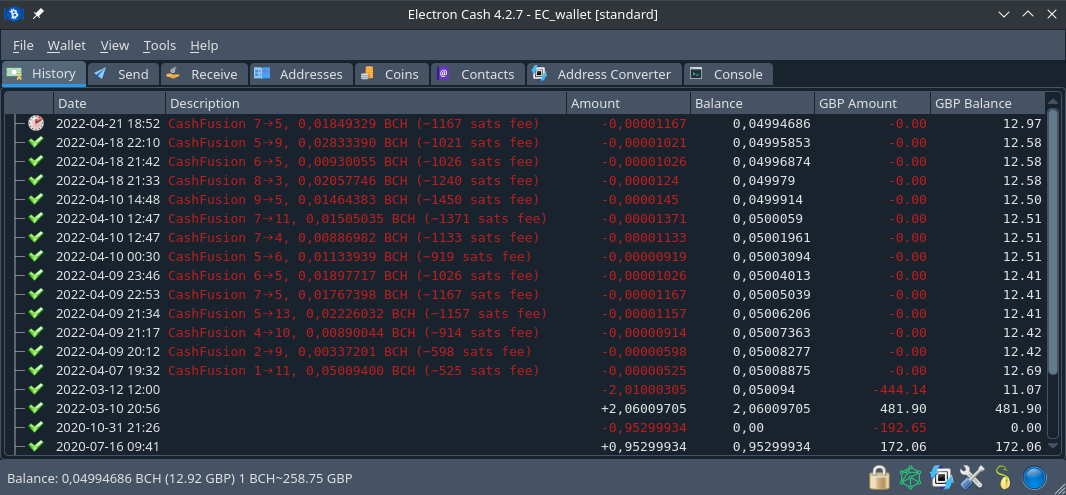

The Electron Cash wallet is without a doubt the most popular Bitcoin Cash desktop wallet.

While the user interface does look a bit old school but the wallet is

actually very easy to use.

Electron Cash has a great reputation in the community because it has a lot of powerful features and

it has been a very reliable wallet with active development since the split in 2017.

The wallet is known as the swiss army knife of BCH wallets because of its wide set of

features.

The wallet supports CashTokens, sweeping paper wallets, requesting a specific amount, scanning (BIP70 type)

payment requests from merchants, cashaccounts, address conversion, multisig, UTXO management

and more! The wallet allows you to specify the derivation path and is compatible with the

bitcoin.com wallet.

The Electron Cash wallet was the first one with the innovative privacy tool Cashfusion implemented.

Because of CashFusion, Electron Cash is the go to wallet for the privacy-minded Bitcoin Cash user.

Under the hood, the Electron Cash wallet does SPV style verification which is another selling point

for the crypto enthusiast.

There's also a mobile version of the Electron Cash wallet but it is not as streamlined as the desktop version.

About Bitcoin Cash

Bitcoin Cash is the biggest crypto-project chiefly focused on becoming a currency.

It was born out of a long

contention

in the bitcoin community about the proper way to scale the system.

From August 1st 2017 the “bitcoiners” who held true to the original ideas of a p2p electronic cash system found their home in

Bitcoin Cash.

The coin has a dedicated community focused on long term scaling with negligible fees and improving its

usefulness.

There has also been a consitent effort to unlock the programmability potential of the

bitcoin scripting system and allow advanced smart contracts, with CashTokens being the most recent improvement.

While the 1MB limit of BTC was certainly not the scaling bottleneck, fundamental improvements have to be

made to the solid Satoshi foundation.

People in Bitcoin Cash believe in on-chain scaling by increasing the blocksize limit and by improving

capacity through innovation and leveraging technological advances in hardware.

Fundamental to this approach, contrary to BTCs, is hardfork upgrading meaning that all BCH nodes have to

be upgraded at the same time. Some of the innovations include better block propagation technology

(Graphene), an improved signature scheme (Schnorr), an overhaul of the transaction ordering, an improved

difficulty adjustment algorithm (DAA) and an adaptive blocksize limit.

Bitcoin Cash has a rich history which includes a "hashwar" against Craig Wright, AKA

faketoshi, on November 15th 2018 and a split to prevent a node implementation from redirecting part of

the minersubsidy to themselves for funding on November 15th 2020.

Through a strange quirk of history many BCH supporters hang out on the subreddit r/btc.

A big selling point of BCH is that it works fast cheap and reliably today with a vibrant

ecosystem of merchants and services accepting it.

BCH has multiple development teams working

on the protocol.

You can get an idea what new features and protocol upgrades are being worked on bitcoincashresearch.org.